Introduction: Understanding the Role of Accounting Software UAE

The UAE’s business landscape has evolved significantly, becoming a global hub for various industries. As companies navigate a competitive market, accounting software has become essential for streamlining financial management, regulatory compliance, and overall efficiency. From small startups to large corporations, selecting the right accounting software UAE can be a strategic move to improve accuracy, enhance transparency, and promote growth. Accounting software assists businesses in automating transactions, generating financial reports, and managing cash flows while meeting the local regulatory requirements. As companies seek the best accounting software in UAE, they benefit not only from the tools it provides but also from a seamless connection to modern financial systems that enhance decision-making.

Choosing the right accounting software is more than just a convenience—it’s a necessity in today’s digital economy. When businesses invest in the right tools, they can streamline their financial processes, avoid costly errors, and focus on growth. Accounting software also enables businesses to stay connected to their consumers by offering financial insights that inform product development and pricing strategies, improving customer satisfaction. Therefore, for any business in UAE, adopting effective accounting software is a step toward better efficiency and a stronger financial position in the market.

Benefits of Using the Best Accounting Software in UAE

Choosing the best accounting software in UAE brings multiple benefits that go beyond simple bookkeeping. One of the primary advantages is improved accuracy in financial records. Manual data entry can lead to errors, but automated systems significantly reduce this risk by handling large amounts of data seamlessly. Another major benefit is time savings. Accounting software allows businesses to automate routine tasks like payroll processing, invoice generation, and tax calculation, freeing up valuable time that can be redirected toward core business activities.

Moreover, the best accounting software in UAE supports regulatory compliance, a critical factor given the strict financial regulations in the region. Businesses must adhere to VAT and other tax requirements, and accounting software simplifies these processes by generating reports and reminders for timely submissions. Additionally, accounting software facilitates efficient cash flow management by tracking expenses, income, and outstanding invoices, ensuring that businesses maintain a healthy cash position. Lastly, accounting software provides valuable insights into a company’s financial health, enabling leaders to make informed decisions, strategize for the future, and connect more closely with their customers’ needs and preferences.

Key Features of Leading Accounting Software in UAE

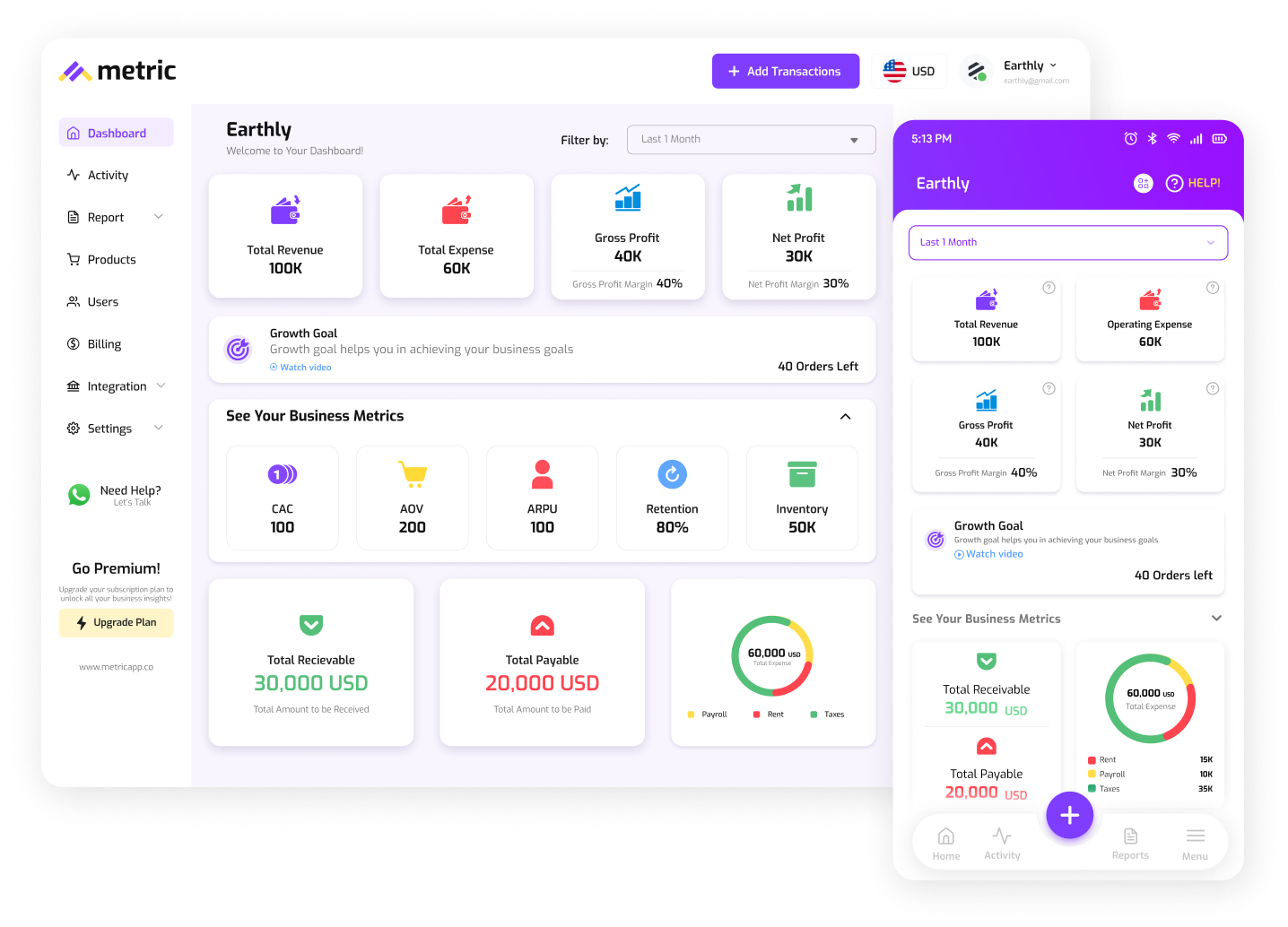

The best accounting software UAE is equipped with several essential features that cater to the specific needs of businesses in this region. Firstly, user-friendly interfaces are crucial. Business owners and employees need an intuitive system that allows them to access financial data without extensive training. The top accounting software platforms provide dashboards with a clear overview of finances, simplifying tasks such as income tracking, expense management, and report generation.

Another critical feature is real-time data synchronization, which ensures that all financial information is up-to-date. This function is particularly useful for businesses with multiple branches or departments, as it enables them to make decisions based on the latest data. Security is also paramount in accounting software, given the sensitivity of financial data. The best accounting software in UAE offers robust security measures, including encryption and access controls, to protect against unauthorized access. Lastly, integration capabilities are essential, as they enable businesses to connect the software with other systems such as inventory management, CRM, and payroll. This connectivity not only saves time but also enhances data accuracy, leading to better decision-making and improved customer satisfaction.

How Accounting Software Connects Businesses to Consumer Needs

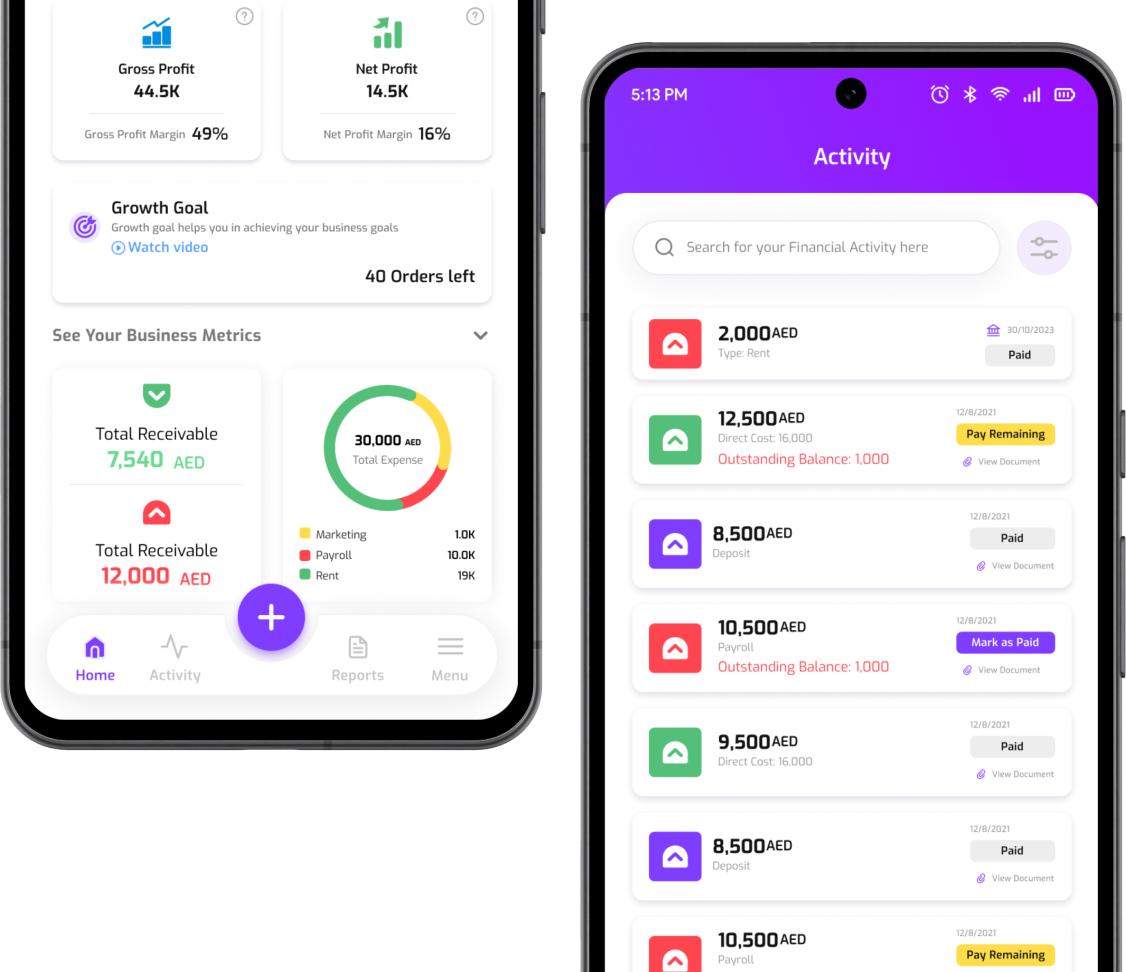

Accounting software plays a vital role in connecting businesses to their consumers by providing insights into financial trends that can inform strategic decisions. For example, analyzing revenue streams and expenses can help a business understand which products or services are the most profitable, allowing for targeted marketing and product improvement efforts. Moreover, accounting software can track customer payments and outstanding invoices, helping businesses maintain healthy cash flow while providing consumers with timely, accurate billing information. By simplifying the financial aspects, businesses can better focus on customer service and tailor their offerings to meet consumer demand.

Furthermore, accounting software facilitates financial transparency, which is increasingly valued by consumers. When a business can accurately report its financial position, it builds trust among customers, partners, and investors. In addition, the insights derived from accounting software help businesses adapt to changing market conditions and consumer behaviors. For instance, if a particular product line is performing exceptionally well, a company may decide to allocate more resources to expand that offering. In this way, accounting software not only helps businesses manage their finances but also serves as a bridge between consumer needs and business strategies, allowing companies to stay competitive and responsive in a dynamic market.

Selecting the Right Accounting Software UAE for Your Business

Choosing the best accounting software in UAE requires careful consideration of the specific needs and goals of the business. The size of the business, the industry it operates in, and the complexity of its financial operations are all factors that play a role in determining the most suitable software. Small and medium-sized businesses may prioritize affordability and ease of use, while larger organizations may focus on advanced features and scalability. Businesses in the UAE must also consider software that complies with VAT regulations and other legal requirements, ensuring smooth and efficient tax processing.

It is important for businesses to assess the customer support and training provided by the software vendor, as these aspects can influence the software’s usability and effectiveness. Additionally, businesses should evaluate whether the software offers customizable options, allowing them to adapt it to their unique needs. A reliable and well-suited accounting software can serve as a foundation for efficient financial management, support business growth, and facilitate a strong connection to consumer preferences. By investing in the right accounting tools, UAE businesses are better positioned to thrive in a competitive market, delivering exceptional value to their customers.

FAQs

1. What is the best accounting software in UAE for small businesses?

The best accounting software for small businesses in UAE typically includes user-friendly interfaces, affordable pricing, and essential features like VAT compliance. Options such as QuickBooks, Zoho Books, and Xero are popular due to their scalability and flexibility, making them ideal for small to medium-sized businesses.

2. How does accounting software help with VAT compliance in UAE?

Accounting software designed for UAE businesses often includes automated VAT calculation, report generation, and reminders for timely submissions. This makes it easier for businesses to comply with the VAT regulations, minimizing errors and avoiding penalties.

3. Can accounting software UAE improve cash flow management?

Yes, accounting software tracks income, expenses, and outstanding invoices, which helps businesses monitor cash flow and make informed financial decisions. This helps maintain a steady cash flow, ensuring the business can meet its obligations and invest in growth.

4. Is cloud-based accounting software secure?

Cloud-based accounting software providers implement robust security measures, including encryption, access controls, and regular security updates. Choosing a reputable provider with a strong focus on data security is crucial to protect sensitive financial information.

5. What features should I look for in accounting software for my UAE business?

Key features to look for include VAT compliance, real-time data synchronization, integration capabilities, security measures, and user-friendly interfaces. These features ensure the software meets regulatory standards while enhancing overall business efficiency.